And with the new RPGT rates announced in the Malaysian Budget 2019 Malaysian citizens will now be charged 5 in property taxes after the 5th year as well where it used to be 0. Is there a way for Thomas to reduce the amount of payable RPGT.

The hike involves an additional 5 in RPGT for disposal of properties owned from 6 years and beyond as well as an increase of 1 in stamp duty for the instrument of transfer for properties exceeding RM1 million to RM25 million.

. That being said it is reported that Capital Gains Tax will not include gains on shares in Budget 2018. It has less impact on genuine buyers compared to speculators. Sections 15 to 18 of the Finance Act No.

As such if the disposal price is lower than the acquisition price there is no profit gained and therefore no RPGT is payable. Real Property Gains Tax RPGT Rates. View RPGT ANSWER SEP2018 FEB2019 SEP2019docx from BFB 3013 at Management and Science University Malaysia.

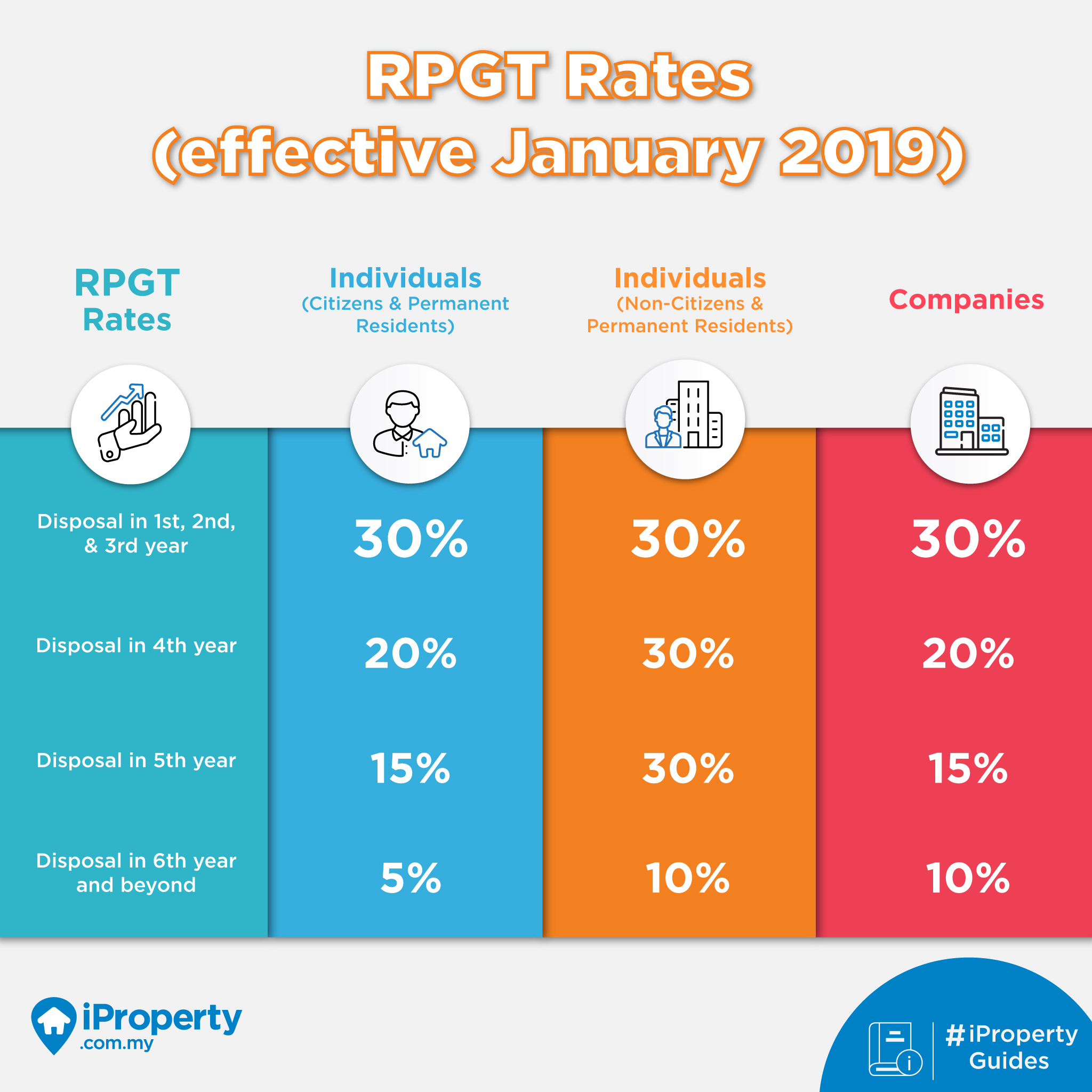

A Short History of RPGT in Malaysia RPGT rates in Malaysia have been at its highest since the year 2014 with tax on the first 3 years standing at 30 the fourth year at 20 and the fifth year at 15. After listening to a podcast on RPGT on BFM899 it is noted that RPGT contributes only 07 of the total revenue received by the government. How to calculate the year of your property disposal.

Corporate tax rates for companies resident in Malaysia is 24. RGPT rate for 3rd Year 30 RPGT Payable selling price - buying price x RPGT Rate RM700000 - RM500000 x 30 RM200000 x 30 RM60000 5. Malaysian citizens andor permanent residents who sell their property within the first five years of acquiring it will be subject to RPGT.

Effective 1 January 2019 the rates of RPGT for property sold after five years is 5 for Malaysians and 10 for foreigners. The following is the RPGT rates effective from 1st January 2014. Real property gains tax rpgt rates that take effect from jan 1.

From the period of 112014 until 31122018 disposal in the sixth year after the date of acquisition of the chargeable asset is nil. November 2 2018. RPGT is only chargeable if there is a profit gained from the disposal of the property.

2014 RPGT RATES Disposal Citizens PR Non-Citizens Companies. There are some exemptions allowed for RPGT. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment.

The RPGT rate for a non-Malaysian citizen is 30 on the gain if the property acquired is less than five years old and 5 on the gain if the property acquired is more than five years old. Non-citizens and companies on the other hand will be charged 10 RPGT when they dispose of their property after more than five years from purchasing it. Continuation of Real Property Gains Tax and its Exemptions.

This alert provides a summary for some of the key amendments it has made to the Real Property Gains Tax Act 1976 RPGT Act which may affect you. The RPGT rates are as follows- 2. Disposal Date And Acquisition Date.

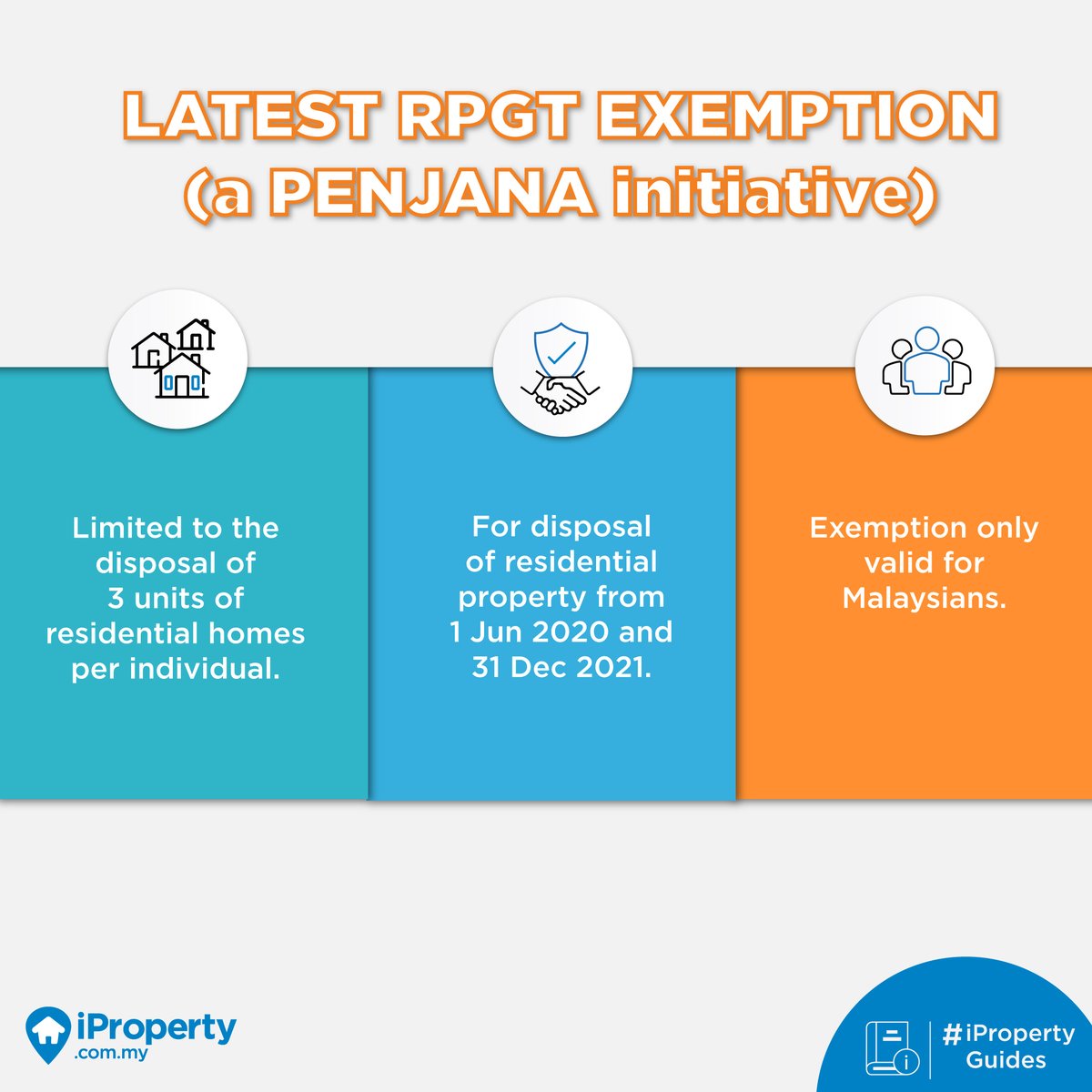

Latest 2019 RPGT Rates in Malaysia 5 Hike Since 2019 Is Malaysian entitled for RPGT exemption. There are people who see tax as a great equalizer that RPGT is a necessary evil to curb. Dated 15 October 2021 after the incorporation of the Budget 2022 Proposals.

When do I have to pay RPGT. RPGT Exemptions tax relief Good news. New Section 21B 1A RPGT Act 1976 Duty of the property buyer to withhold part of the consideration and remit it to Inland Revenue Board of Malaysia IRB.

Yes for Malaysian it is a once in a lifetime so you must not have applied before this or it could also mean for first time seller BUT ONLY for residential property disposal. - other than companies non-citizens and non- resident individuals 44 - companies 45 - non-citizens and non-resident individuals 46 5 Date of disposal and date of acquisition Determination of disposal date Example 151 and acquisition date 52. 2 2017 Act 801 has come into operation on 1 January 2018.

The DGIR shall raise an assessment based on the RPGT returns. The RPGT is calculated for RM200000. Returns and assessment For each disposal both the disposer and acquirer are required to submit RPGT return respectively within 60 days from the date of disposal.

2 Foreigners Non-Citizens Foreigners will be charged a rate of 10 RPGT when they sell their property five years or more after purchasing it. Real Property Gains Tax RPGT Rates. Is a company incorporated in Malaysia or a trustee of a trust or body of persons registered under any written law in Malaysia.

I Retention Sum for Non-Citizen and Non-Permanent Resident Previously in the case where the. RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. RPGT implication to transferor.

As of 1 january 2018 the new corporate income tax act is applicable according to which the companys profit is taxable at a rate of 20 only upon the. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550 Youll pay the RPTG over the net chargeable gain. Reference can be made to the RPGT Guidelines dated 13062018 or 18062013 whichever is applicable.

I believe it impacts a lot more on long-term property investors over short-term speculators who gain from flipping properties. It would make more sense for the government to increase the Real Property Gains Tax RPGT rates within the first five years instead of imposing a 5 tax rate for Malaysian individuals after the fifth year said the Association of Valuers Property Managers Estate Agents and Property Consultants in the Private Sector Malaysia PEPS. As prescribed by law the purchasers solicitors are required to retain 3 of the purchase price from the deposit and remit the same to the Inland Revenue Board within sixty 60 days from the date of the sale and purchase agreement to meet the RPGT payable.

4 RPGT rates Shows the rates applicable to the following disposers. RPGT rates for property sold within three years and on its fourth and fifth years remain fixed at 30 20 and 15 respectively. It is the imposition of 5 Real Property Gain Tax RPGT for gains received from disposal of properties after the fifth year of owning them.

So heres a look into the possible effects that might be felt by the buyers and sellers of the property market. Effective from 112018 rpgt has been extended to apply to executors of the estate of a deceased person who is not a. Our Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz has presented the Budget 2022 themed Keluarga Malaysia Makmur Sejahtera in Parliament on 20 October 2021.

One of the highlights of the. Part III Schedule 5 RPGT Act. No RPGT implication Reason.

4 - RPGT rates for disposals made in the 6th year and subsequent years reduced to 0 wef. If you owned the property for 12 years youll need to pay an RPGT of 5.

Top Things To Live Near That Affect Home Values

The Ultimate Real Property Gain Tax Rpgt Guide

What Is Real Property Gains Tax The Malaysian Bar

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

Taxplanning Rpgt Exemption The Edge Markets

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

Guide To Malaysian Real Property Gain Tax Rpgt

What We Need To Know About Rpgt

Real Property Gains Tax Part 1 Acca Global

Your Realty Partners Property Consultants Home Facebook

Is 5 Rpgt A Tax On Inflation Part 1 Propsocial

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Malaysia Commercial Industrial Property Home Facebook

Shylendra A S Nathan Sasnathan Twitter

Shylendra A S Nathan Sasnathan Twitter

Key Changes In The Real Property Gain Tax Cheng Co Group

Real Property Gains Tax Part 1 Acca Global

Comprehensive Measures Needed For Property The Star